best tax saving strategies for high income earners

Our tax receipt scanner app will scan. Max out Retirement Accounts and Employee Benefits.

Self Employment Tax Rate Higher Income Investing Freelance Income

50 Best Ways to Reduce Taxes for High Income Earners.

. High-income earners make 170050 per year. Ad Open a New Savings Account in Under 5 Min. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Make Tax-Smart Investing Part of Your Tax Planning. 50 best ways to reduce taxes for high income earners 1.

Dont discount the wealth-generating potential and flexibility an HSA can afford. The SECURE Act. Tax planning strategies for high-income earners.

Find a Dedicated Financial Advisor Now. In this post were breaking down five tax-savings strategies that can help you keep more money in. The abovementioned tax strategies for high-income earners in 2022 are great ways to cut tax bills.

A Solo 401k for your business delivers major opportunities for huge tax. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs. For example our tax professional can look at your current portfolio and enhance your savings to ensure you arent paying unnecessary taxes just because its not structured correctly. Connect With a Fidelity Advisor Today.

A donor-advised fund is a charitable fund that allows you to decide how and when to allocate funds to charitiesThis is probably one of the best tax saving strategies for high income. Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

As a high-income earner its vital to have a comprehensive understanding of the tax laws that apply to you. View the Savings Accounts That Have the Highest Interest Rates in 2022. Do Your Investments Align with Your Goals.

Visit The Official Edward Jones Site. In some situations higher income means adjusted gross income or AGI of 186000 for IRA contributions or 315000 for the new business income deduction for. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

We will begin by looking at the tax laws applicable to high-income earners. The best possible way of identifying tax strategies and incentives would. New Look At Your Financial Strategy.

Start Maximizing Your Interest Today. The more you make the more taxes play a role in financial decision-making. The more taxable income you have the higher your federal income.

If you are an employee. You can deduct the amount you contribute to a tax. In fact Bonsai Tax can help.

The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions. An overview of the tax rules for high-income earners. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services.

Connect With a Fidelity Advisor Today. Well this is precisely what we will cover in this section along with numerous other techniques to. Next if eligible high income earners should fully fund a health savings account each year to further shelter income.

This might lead you to wonder what the best tax deductions for high-income earners are. Build an Effective Tax and Finance Function with a Range of Transformative Services. In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in.

A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. Max Out Your Retirement Account. One of the tax reduction strategies for high income earners that I think a lot of people dont fully understand is selling inherited real estate.

Selling Inherited Real Estate.

Tax Strategies For High Income Earners Wiser Wealth Management

High Income Earners Fail To Appreciate The Math Of 529 Plans Part Ii Resource Planning Group 529 Plan Saving For College Retirement Savings Plan

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

The Hierarchy Of Tax Preferenced Savings Vehicles

Is A Backdoor Roth Ira A Good Move For Higher Income Earners In 2022 Roth Ira Higher Income Income

6 Strategies To Reduce Taxable Income For High Earners

A Back Door Roth Ira Strategy Benefits High Earners Strategies Ira Roth Ira

Who Benefits More From Tax Breaks High Or Low Income Earners

Hierarchy Of Tax Preferenced Savings Vehicles For High Income Earners Fairpoint Wealth

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

Tax Strategies For High Income Earners Wiser Wealth Management

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

5 Outstanding Tax Strategies For High Income Earners

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

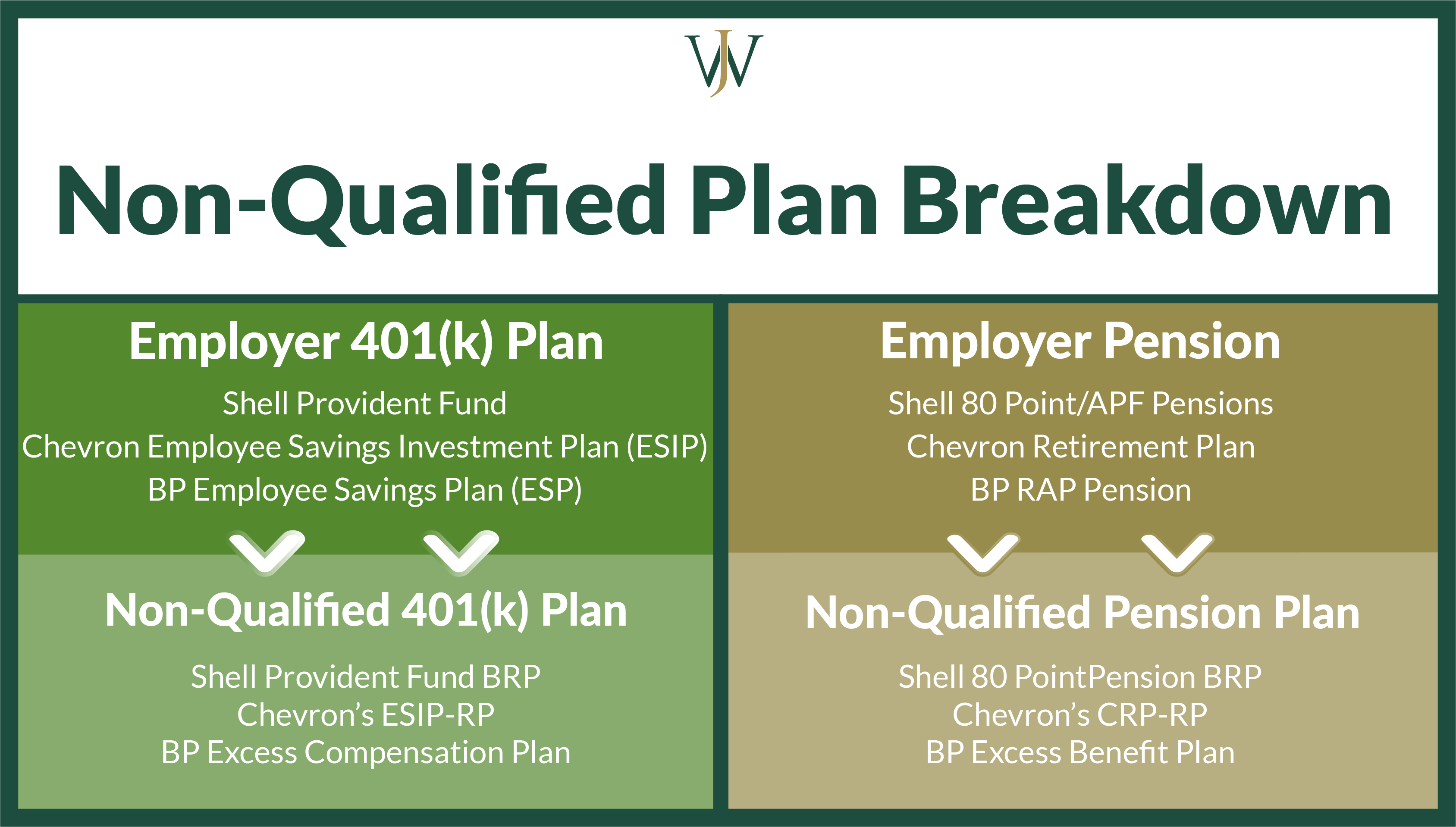

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark